I received a request from one of my friends in Singapore to review a mutual fund that his banker had recommended to him. I thought why not list my findings in my blog so that it could be of use to others, and probably create a separate section on this blog dedicated to investments in various financial instruments.

Singapore’s mutual fund industry is vibrant with a lot of fund houses operating with a lot of funds. I will write a brief about the mutual fund industry of Singapore shortly. In this article, I shall just discuss about this one fund called Singapore Dividend Equity Fund.

As the name suggests it is focussed on companies giving decent dividends. The fund has a portfolio of about 41 stocks, most of them listed in the Singapore Stock Exchange, and many of the stocks are a part of the Singapore Straits Times Index. The fund size is decent - about SGD 564 million.

One thing that caught my attention is the fund expenses, I think these are quite high when compared to funds offered in India. However, they are roughly on par with what you see in markets such as London, Zurich and other places in Europe.

Initial Sales Charge = Upto 5%

Management Fees = 1.25%

The minimum investment is SGD 1,000, with subsequent investment being $100. I guess anyone drawing salary of above SGD 4,000 should find the initial investment to be alright, but anyone below it might find it a bit high.

The fund is managed by Nikko Asset Management Asia Limited.

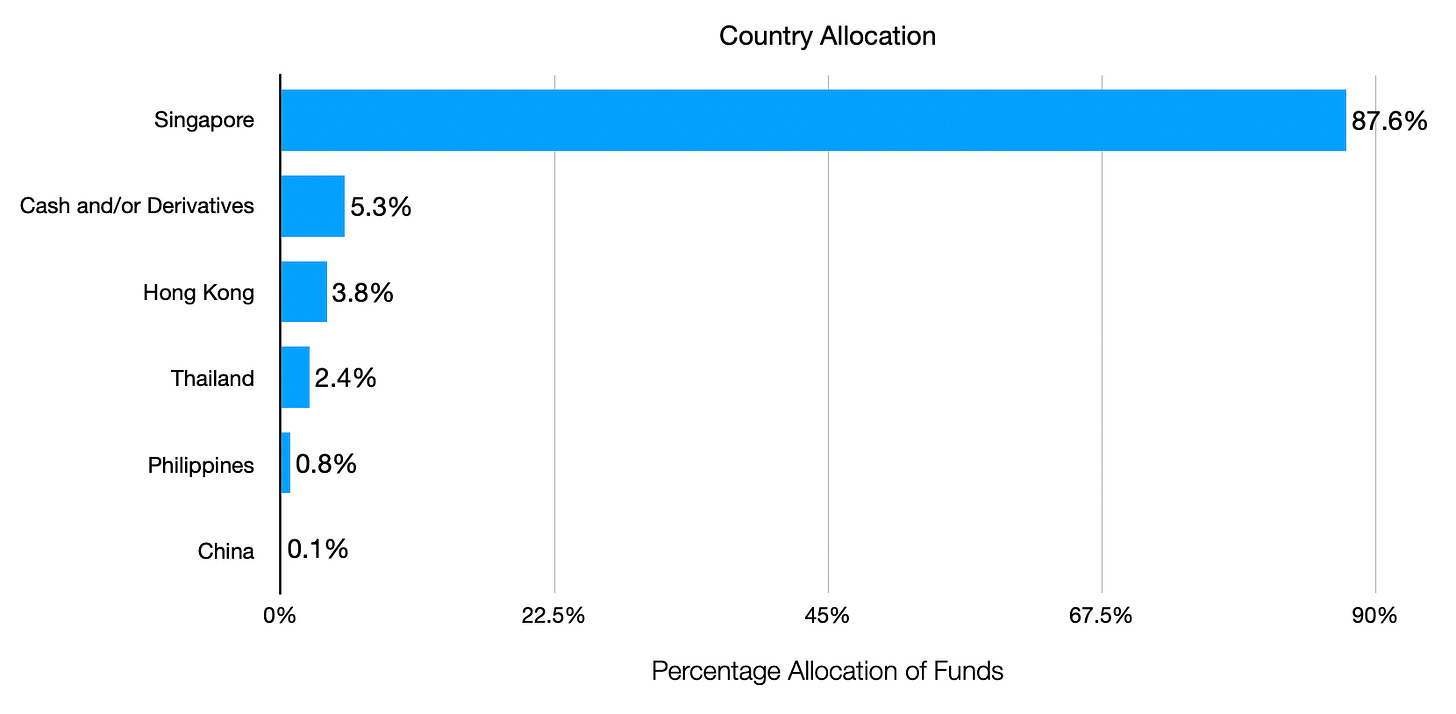

The fund invests in stocks not just in Singapore but in other neighbouring countries as well. The below is the country allocation of funds in 2023.

The fund performance is alright but not good when compared to its peers and the performance of the stock market in general in Singapore.

The below is the performance of this fund for the last five years.

Over the last five years, the Singapore equity market has not performed great. However, from the depths of Covid to this day (May 2023), the Singapore Straits Times Index (STI) has given a return of about 32%. We do expect equal or competent returns from the any fund that is similar to the index. Even after considering the dividend payouts, the returns do not stack up to index returns. Of course, the fund is not mimicking any index. Its investment style is close to disregarding benchmark. But irrespective of the style of fund management, investors do expect returns from a diversified equity fund with a FSM risk rating of 8 out of 10.

The below is the performance of the Singapore Straits Times (STI). Notice the improvement from the bottoms of 2020 to the current period. That’s about 32% return in the last 2.5 years.

The sector allocation is decent.

However, I think there are better options available for investments. Investors could be better off looking at the following funds.

Lion Global Vietnam Fund

SingLife MM Capital Growth

UBS Global Emerging Markets Opportunities Fund

SPDR STI ETF

Infinity Global Stock Index Fund

Probably, investing in Singapore STI ETF would be better, one can save on fund expenses.